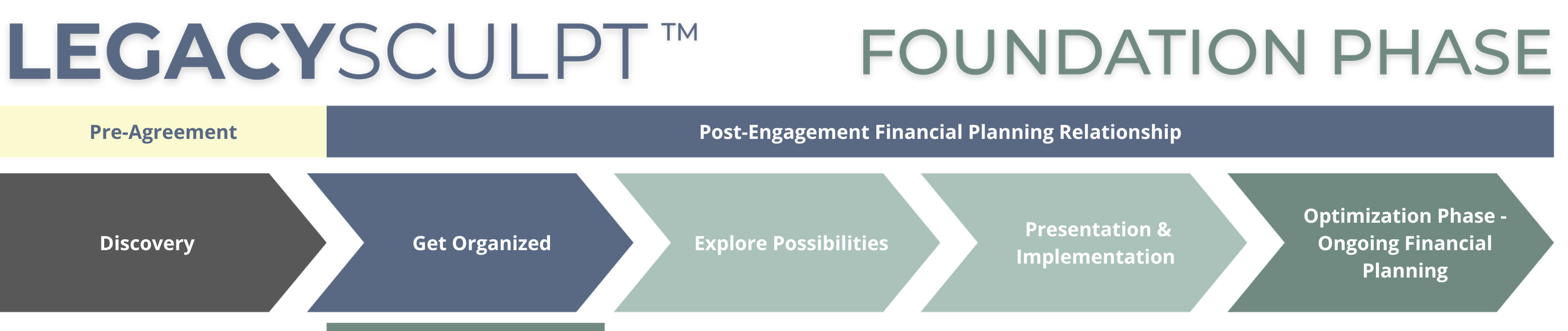

Your Path to an Organized Financial Life—Start Your Journey with Intent

GET ORGANIZED MEETING

Build peace of mind by organizing the pieces of your financial life.

Meeting Details

Purpose: To help you gather and organize your financial documents and accounts so we can build your financial plan on a solid foundation.

Duration: 60-90 minutes

Location Options: Zoom, Google Meet, Microsoft Teams, or In-Person

Scheduling: This meeting is scheduled after your engagement agreement is completed. A scheduling link will be provided by email.

Fee:

Ongoing engagements: Included in your service package

Project-based engagements: Invoiced at the agreed-upon hourly rate following the meeting

Expectations

The Get Organized Meeting is designed to give your financial life structure and clarity. Before building your financial plan, we’ll work together to gather, sort, and organize your key documents and accounts. By the end of this session, you’ll feel confident knowing your financial information is in order and ready for the next step in our planning process.

What to Do to Prepare

1. Gather Key Documents

Recent tax returns—we use Holistiplan to analyze your tax return for tax savings opportunities.

Bank, retirement, and investment account statements

Insurance policies (life, disability, long-term care, health)

Mortgage, loan, and debt statements

Estate planning documents (wills, trusts, powers of attorney)

👉 Use our Document Checklist for a full list.

2. Organize Your Digital Access

Ensure you can log in to your bank, investment, and retirement accounts online.

Update old passwords or security questions if needed.

Be ready to connect accounts to RightCapital during the meeting.

3. Clarify Your Financial Picture

List your sources of income and approximate monthly expenses.

Note any upcoming major life events (retirement, new child, relocation, inheritance).

Think about financial “pain points” where you want more clarity.

4. Bring Your Questions

What worries you most about your financial situation?

What opportunities do you feel you might be missing?

What do you want your money to help you achieve in the next 3–5 years?

5. Get in the Right Frame of Mind

Expect this meeting to feel like “clearing the desk” of your financial life.

Don’t stress if you don’t have everything perfectly organized — that’s what we’re here for.

The goal is progress and clarity, not perfection.

6. Complete the Client Onboarding Form

Helps streamline account openings and administrative setup.

Ensures we have accurate information before we meet.

Saves time in the meeting so we can focus more on your financial goals.

7. Technical Preparation (if virtual)

Test your camera and microphone before the meeting.

Ensure a stable internet connection.

Keep scanned documents handy (PDFs in a desktop folder work best).

What Happens in the Meeting

Review your gathered financial documents together.

Identify and request any missing or outdated information.

Link your accounts into our financial planning software —RightCapital.

Walk through the RightCapital Vault and organize digital files into secure folders.

Ensure you leave with a sense of clarity and confidence moving forward.

Looking Ahead

This meeting sets the foundation for your financial plan. In our next session, Explore Possibilities, we’ll analyze your current financial picture together in RightCapital and begin shaping strategies tailored to your goals.

Useful & Timely Resources

Documents To Keep On File — ( PDF | Interactive )

Important Milestones — ( PDF )

Issues To Consider As A New Client — ( PDF | Interactive )

Master List of Goals — ( PDF | Interactive )

Important Numbers — ( PDF )

Starting Out Financially — ( PDF | Interactive )