Discovery Meeting — Clarify Goals, Priorities & What Success Looks Like

A focused conversation to understand your situation, values, and what you want your money to accomplish.

Our Discovery Meeting is a guided discussion that helps us understand your goals, priorities, and financial picture at a high level. We’ll talk through your current concerns, what’s working, and where you want more clarity—so we can recommend a right-sized path forward. Since we are led by a CERTIFIED FINANCIAL PLANNER® and IRS Enrolled Agent, we integrate planning and tax strategy from the start.

Discovery Meeting Details:

Duration: 45-60 minutes

Location Options: Zoom, Google Meet, Microsoft Teams, or Phone Call. In-person by request.

Scheduling: Meeting will be scheduled during Introductory Call or the link will be emailed.

Fee: No cost for this meeting.

Who Should Attend: Decision-makers (spouse/partner or business partner if applicable).

What You’ll Receive: A concise recap with next steps and, if appropriate, a recommended engagement option.

Expectations for the Discovery Meeting

Purpose: Align on what matters most to you and define the problems we’re solving.

Outcome: A clear understanding of your objectives and the next best step in the LEGACYSCULPT process.

Tone: Conversational, structured, and pressure-free—this is about fit, clarity, and usefulness.

What we won’t do: We won’t ask you to move accounts or make product decisions. No investment commitments here.

What to Do to Prepare for the Discovery Meeting

Top 3 priorities: Jot down the outcomes that would make this year a win (e.g., retirement clarity, tax reduction, cash-flow confidence, investment alignment).

Recent changes: Note life or business events that could change strategy (new job, equity comp, business formation, inheritance, sale, etc.).

Key questions: Bring the 2–3 questions you most want answered first.

Documents (optional, helpful): Latest tax return, investment statement(s), and any benefits/equity comp summaries—only if easy to grab.

Decision context: If you’re weighing options (retire now vs. later, Roth conversions, entity election), tell us your timeline and constraints.

Communication preferences: Tell us how you like to meet, receive updates, and make decisions (fast draft vs. deep dive).

For business owners: Share your entity type, payroll status, and any current advisors we may coordinate with.

Complete your LEGACYSCULPT Profile: Filling out this short form in advance helps us streamline the meeting, avoid duplication, and tailor our conversation to your specific needs.

What Happens in the Discovery Meeting

Welcome & agenda: Confirm your priorities and desired outcomes for today’s discussion.

Discovery conversation: Goals, values, cash flow, taxes, investments, benefits, risks, and estate basics—only what’s relevant.

Initial observations: What’s going well, where we see friction, and which levers likely create the biggest impact.

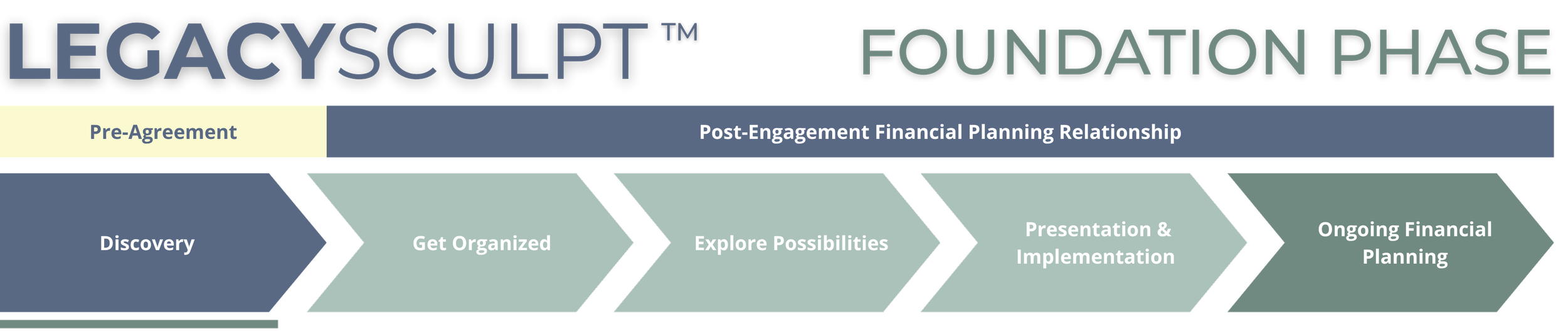

Plan the path: We’ll outline the recommended next step in the LEGACYSCULPT Foundation Phase (typically Get Organized Meeting) and confirm deliverables and timeline.

Q&A: We leave time to address your immediate questions.

Looking Ahead

If we’re a mutual fit: We’ll send a short recap, engagement paperwork (via AdvicePay/DocuSign), and onboarding instructions.

Onboarding next step: You’ll receive RightCapital access and a secure link to share documents.

Next meeting: Typically Get Organized (data gathering & baseline)

Useful & Timely Resources

Documents To Keep On File — ( PDF | Interactive )

Important Milestones — ( PDF )

Issues To Consider As A New Client — ( PDF | Interactive )

Master List of Goals — ( PDF | Interactive )

Important Numbers — ( PDF )

Starting Out Financially — ( PDF | Interactive )