Close the Year with Confidence — Reflect, Refine, and Finish Strong

LEGACYSCULPT Year-End Milestone Review

Meeting Details

Purpose: Complete your year-end check-in—review progress, confirm retirement income and investment positioning, and coordinate tax planning opportunities before December 31 so nothing important gets pushed into “next year.”

Duration: 60-90 minutes

Location Options: Zoom, Google Meet, Microsoft Teams, or In-Person

Scheduling: Existing clients can schedule via your client link.

Next Session: Monday, October 27, 2025 - Friday, December 19, 2025

What This Meeting Is For

Use this section as bullets:

Confirm you’re on track with your retirement income strategy and long-term goals

Identify and execute year-end tax planning opportunities (while there’s still time)

Review cash flow, savings, spending, and major life changes from the year

Stress-test your plan for the year ahead (markets, inflation, taxes, healthcare, etc.)

Prioritize action items so nothing slips into “we’ll get to it later”

What to Prepare

To keep this meeting high-impact, please complete these items in advance:

RightCapital connections updated at least 2 weeks before your meeting

(This ensures your plan, projections, and account data are accurate.)Upload any relevant documents at least 7 days before the meeting:

Recent paystubs (if still working)

Most recent investment / retirement account statements (if connections aren’t available)

Any updates: pensions, Social Security decisions, new insurance, business changes, major purchases/sales

If you need to upload files, please use Verifyle or RightCapital

What We’ll Cover

1) Year-End Plan Snapshot

A clear look at where you are today vs. where you planned to be—net worth, cash flow, accounts, and key milestones.

2) Retirement Income & Withdrawal Strategy

We’ll check your withdrawal plan, tax bracket management, Roth strategy, RMD planning (if applicable), and income sources for next year.

3) Investment & Risk Alignment

We’ll confirm your portfolio still matches your risk tolerance, time horizon, and goals—then make adjustments if needed.

4) Tax Planning Before December 31

We’ll look at the most relevant opportunities for you, such as:

Roth conversions / bracket-filling

Capital gains and loss harvesting

Charitable strategies (including QCDs if eligible)

Withholding and estimated tax adjustments

Timing of income and deductions (where applicable)

5) Next-Year Priorities and Implementation Plan

You’ll leave with a short, prioritized list of next steps—what we’re doing, what you’re doing, and the target timing.

What You’ll Walk Away With

A clear year-end action plan (with deadlines where applicable)

Tax-smart recommendations tailored to your situation

Confirmed retirement income strategy for the coming year

Updates to your RightCapital plan and projections

A prioritized list of next steps—simple, clear, and executable

Looking Ahead

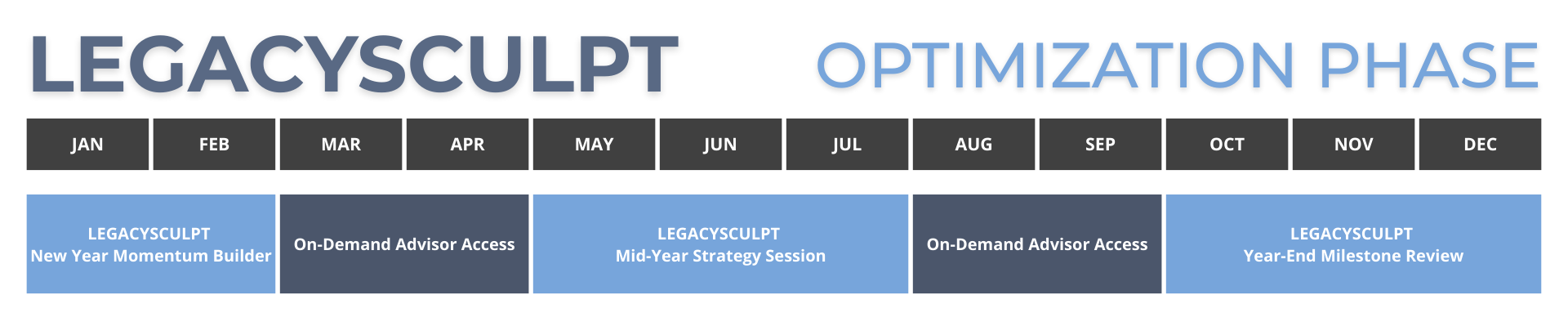

After the Year-End Milestone Review (held mid-October through December 31), we’ll carry your updated strategy into the new year and follow through on any action items we identified. Next, we’ll reconnect during your New Year Momentum Builder (January–early February) to confirm priorities and start the year organized. From there, we’ll continue progress through LEGACYSCULPT Touchpoints as needed and reconvene for the LEGACYSCULPT™ Mid-Year Strategy Session (May 1–July 31) to refine your plan midstream. If circumstances change—markets, tax law, work, or family—we adapt in real time so your plan stays aligned and effective, and you can schedule an On-Demand Advisor Access meeting anytime you need it.

Useful & Timely Resources

Documents To Keep On File — ( PDF | Interactive )

Important Milestones — ( PDF )

Issues To Consider As A New Client — ( PDF | Interactive )

Master List of Goals — ( PDF | Interactive )

Important Numbers — ( PDF )

Starting Out Financially — ( PDF | Interactive )